Software Development for the FinTech Industry

Our FinTech services focus on nurturing and growing your financial tools. We ensure you get the best ROI on your investments.

Over the last decade, FinTech growth has been strong. However, with an increasingly competitive market, fintech software solutions will keep you growing. Custom fintech software development can enhance your services. It secures transactions, streamlines operations, and maintains a competitive edge.

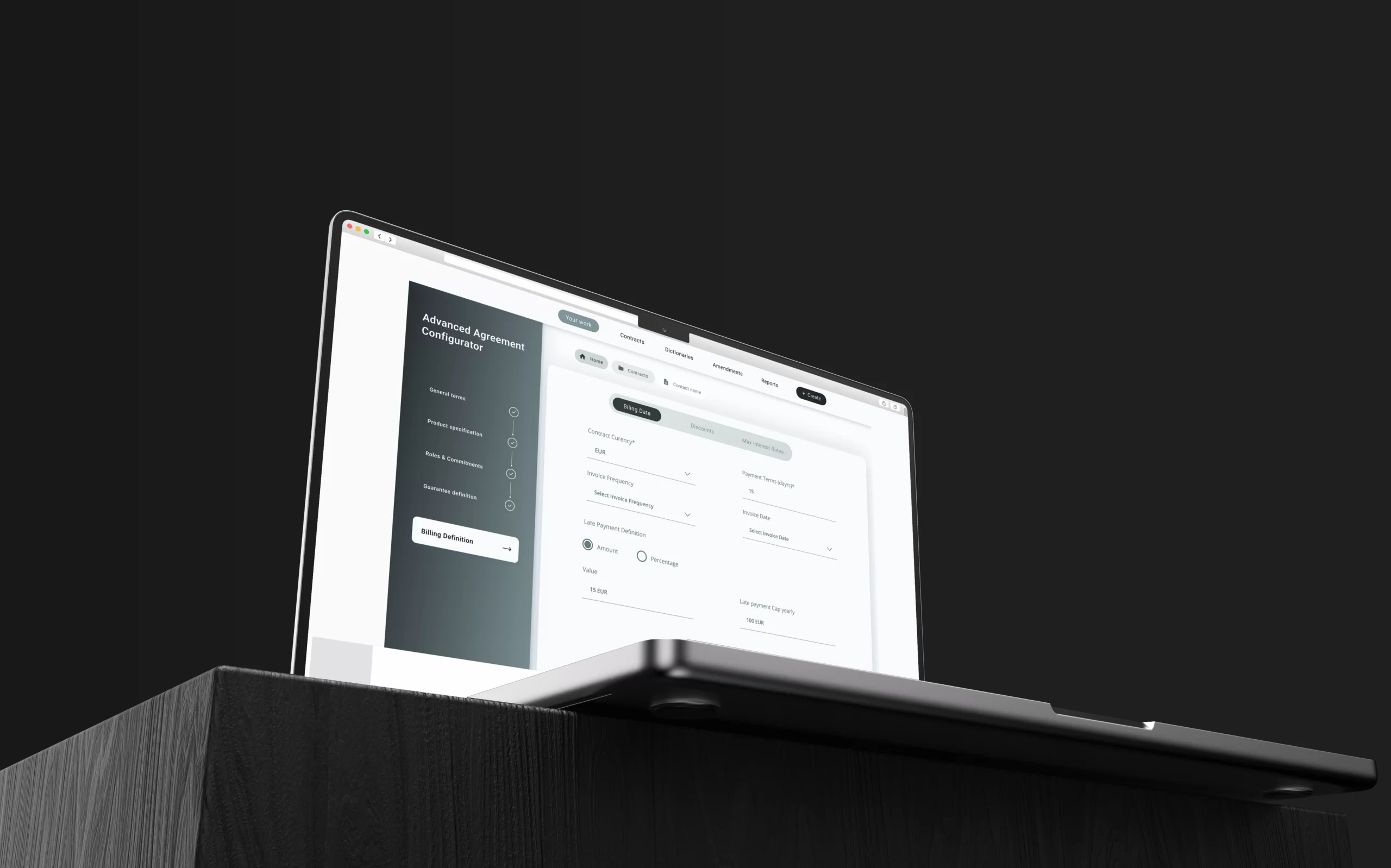

Discover the Transformative Power of Custom Software in Renewable Energy

See how an Advanced Contract Configurator in renewable energy boosted decision-making, cut costs, improved user satisfaction, enhanced reliability, and streamlined contract management

Trusted by / Our Clients:

Key Areas Where Software Development Benefits the FinTech Industry

Payment Processing and Transactions

Tailored FinTech software improves payment processing, ensuring security, efficiency, and speed. This builds trust and satisfaction among users.

Regulatory Compliance and Security

Compliance with strict regulations, including Anti-Money Laundering (AML) directives, Payment Card Industry Data Security Standard (PCI-DSS) compliance, and the Markets in Crypto-Assets (MiCA) framework.

Customer Relationship Management (CRM)

Transforms customer interactions by automating and optimizing processes, resulting in personalized experiences and higher customer retention rates.

Risk Management and Fraud Detection

Specialized fintech software offers advanced risk detection and management capabilities. Utilizing sophisticated algorithms and machine learning techniques, it enhances fraud detection, ensuring safer financial platforms.

Data Analytics and Reporting

Specialized software development services in fintech enable the analysis of extensive financial data. This capacity is crucial for deriving valuable insights that aid in informed decision-making and strategic planning for fintech companies.

Software Delivery Process

Our development process is anchored in best practices. It is certified by ISO 27001 for information security management. This ensures that our FinTech solutions meet global standards for security and reliability.

Exploration

We start by understanding your needs through requirement gathering, user research, and planning. This phase sets the foundation with a clear project overview and initial design concepts.

Project Kick-Off

This phase aligns the team and details the development plan, establishing the roadmap and assigning tasks based on skills for efficient execution.

Development

Our team dives into coding using Agile methodologies, working in sprints to build, test, and refine the software in iterative cycles for optimal results.

Continuous Development Support

Post-launch, we continue to adapt and enhance the software, ensuring it meets evolving needs and remains robust against market changes.

Choose the Best Delivery Model for You

Dedicated Team

Dedicated Team offers a full-time, committed team for long-term projects, ensuring seamless integration with your business goals.

Staff Augmentation

Staff Augmentation fills specific skill gaps quickly, offering flexibility and expertise on a temporary basis to accelerate project delivery.

Why Inspeerity for Software Development in Fintech?

Custom software development brings many benefits, driving transformation and growth. Some of the most significant benefits include:

PSD2 Compliance

Our software ensures that your fintech solutions meet the strict requirements of the Revised Payment Services Directive (PSD2) in Europe.

This means your customers' transactions are secure, enhancing trust and loyalty.

Regulatory Compliance Assurance

We understand the importance of regulatory compliance in fintech. By subjecting our software to thorough checks by organizations like the Financial Action Task Force (FATF), we ensure your business stays ahead of regulatory demands, avoiding penalties and reputational risks.

Better Customer Experience

Retaining clients and boosting your end-user experience helps your bottom line. Custom FinTech solutions focus on customer service, offering personalized and efficient interactions. This strategy boosts customer satisfaction and loyalty, giving you an edge in the competitive financial market.

ISO 27001 Certification

Security is fundamental in fintech. Our software development process is backed by ISO 27001 certification, guaranteeing that your solutions are built with the highest standards of security. This protects your data and your customers' information, instilling confidence in your brand.

Data-Driven Decisions

Overwhelmed by data but not sure how to use it fully to your advantage? Our FinTech software development emphasizes access to real-time data and analytics, enabling your business to make informed, strategic decisions. This approach improves overall business performance by harnessing the power of data.

Strategic Market Positioning

Being able to stand out from the crowd is one way to keep your business growing. Customized UI and services built around the end-user means higher retention rates. Our software development services enable quick adoption of new technologies and processes, positioning your business as an industry innovator. This strategic approach helps attract more customers and expand market share, solidifying your competitive position.

Software development for FinTech

If you’re wondering how custom fintech software development can elevate your FinTech operations, consider these areas. If you are looking to improve in any of these, reach out to us. We’re here to chat about a solution tailored just for you.

Dealing with complex financial transactions

A custom software solution enhances the efficiency and security of your transaction processes. This could help minimize errors, speeding up transactions, and bolstering customer confidence. Integrating robust encryption and fraud detection systems ensures secure and swift handling of complex financial transactions.

Struggling with outdated financial systems

Adopting cutting-edge technologies like AI, blockchain, and machine learning can impact your competitiveness and innovation. Custom software development tailors these advanced technologies to your unique FinTech needs, offering solutions that are scalable, secure, and capable of handling complex financial operations.

Concerns over regulatory compliance

Concerns over regulatory compliance are addressed by institutions like Financial Action Task Force (FATF), where our clients’ software consistently passes inspections. Simplify compliance with a custom software solution, automating updates and checks to stay ahead of regulatory demands and mitigate risks.

You’re looking to improve your customer retention

Improve your client engagement and retention with a software solution that personalizes customer experiences, making interactions more efficient and tailored. This solution enables deeper insights into customer behavior and preferences, leading to enhanced customer service and relationship management.

Risk management and fraud detection challenges

Implement advanced algorithms and machine learning for real-time monitoring and detection of fraudulent activities, enhancing the security of your financial operations. These solutions proactively identify potential threats, ensuring that your financial assets and customer data remain secure.

Data overload without insights

Use custom software to analyze extensive financial data, providing actionable insights for strategic decision-making and enhanced financial services. This involves utilizing data analytics and visualization tools to transform raw data into meaningful information.

Lagging in digital transformation

If you’re not using the full potential of digital technology, custom software can be the spark for transformation, streamlining operations, and opening new opportunities. It integrates cutting-edge digital solutions, ensuring that your financial services remain relevant and competitive.

Environmental concerns over your operations

If sustainability is part of your ethos, software can play a crucial role in reducing your digital carbon footprint, optimizing resource use, and promoting eco-friendly practices. This involves implementing energy-efficient software solutions and promoting sustainable practices within the digital infrastructure of your FinTech operations.

Digital

transformation

in fintech

Whether you’re a small startup or a big bank, our services are designed just for you. From making payments easy to giving you better ways to manage money online, we’ve got what you need to grow your business.

MEET ONE OF OUR TECH EXPERTS

Piotr Filipowicz

Java/Cloud Lead Architect

I understand that tackling tech challenges can be daunting. With 18 years of experience in IT, my goal as your consultant is to turn these challenges into successes. I’m dedicated to providing more than just technical solutions.

Innovate fintech solutions with us

Trusted by

FAQs

Explore answers to common queries regarding Inspeerity’s features, benefits and how it can transform your journey

01.How can custom FinTech software benefit my business?

Fintech software development can enhance security, improve efficiency, create better customer experiences, drive innovation, inform data-driven decisions, and strengthen your market position.

02.What areas can software development improve FinTech?

Payment processing, regulatory compliance, customer relationship management, risk management, and data analytics can all be optimized with custom software.

03.What are the key benefits of Inspeerity's FinTech software development?

We offer enhanced security and compliance, improved efficiency, better customer experiences, innovative solutions, data-driven decision-making, and strategic market positioning.

04.How does your development process work for FinTech?

We identify your needs, select the right software model, develop and test the solution, deploy and integrate it, provide ongoing support, and evaluate ROI.

05.Do you have experience with specific FinTech challenges?

Yes, we can help with complex transactions, outdated systems, regulatory compliance, customer retention, risk management, data overload, and digital transformation.